An Overview on Impact of GST in Restaurant Industry

The restaurant industry has regularly been under the scanner since demonetization. This industry in India is on constant growth and is now impacted with GST – Goods and service tax. Hence, we thought of giving you a detailed impact analysis about GST on the restaurant industry. If we talk of GST in simple terms, it is going to make luxury restaurants unhappy since they are likely to be more impacted and will have to pay whopping 28% GST tax.

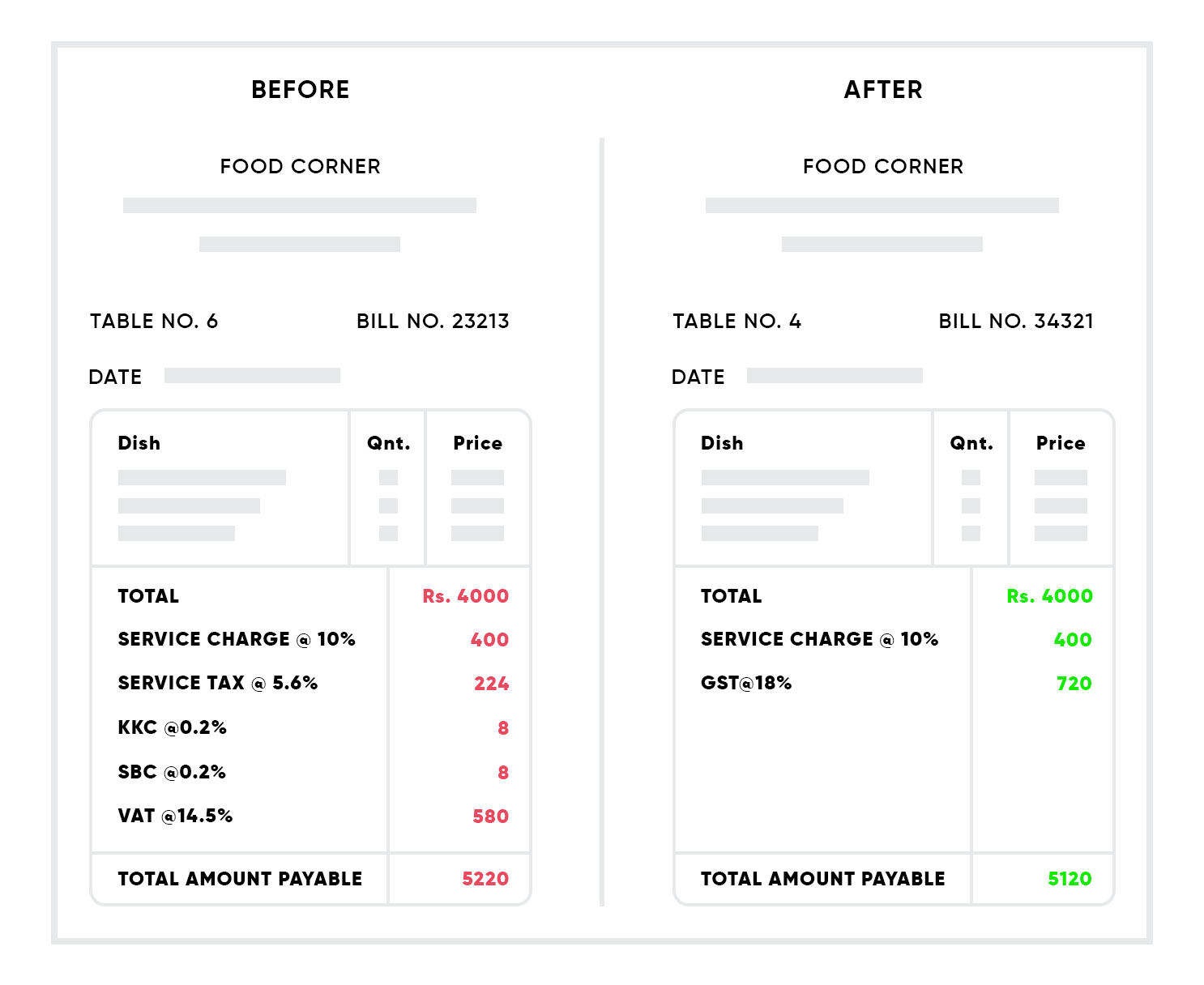

Our goal in this article is to elaborate how restaurant food bills will look with the effect of GST. We will also see how end consumer will pay with the GST effect.

If we look at the current statistics of the restaurant market industry, as per Indian Food Service Report 2016 it is estimated to be worth 3.09 Lakh Crore. The report also stated that the food market of the country has directly employed more than 5.8 million in 2016. One of the key contributors to this growth is the middle-class sector of the country. With access to the lifestyle adopted by western countries, women empowerment gaining stand, high disposable income and reliable mobile network availability, this section of society contribute more to the growth of most of the businesses in the country.

This reflection is seen in the enviable waiting during weekends at almost every restaurant around the corner of the city be it small or a metro. With this being noted, the biggest question right now is how many of us have actually looked into our restaurant bill? We hardly know how much we are paying for actual bill. Let’s analyze how much we are going to pay with GST.

GST Impact on Our Regular Food Bill

Even the regular items like tea/coffee will have an effect. Consumer drinking tea/coffee for Rs 5 these days will now pay Rs 5.60 and this though being a small amount is going to pinch their pockets.

GST BIFURCATION AS PER RESTAURANT

Dhabas & Small Restaurants – 5%

Non- Ac Restaurants – 12%

AC Restaurants – 18%

Five Star Restaurants – 28%

Considering the standard rate of 18% of GST, every restaurant bill payer can save around Rs. 55 on the bill of Rs. 2,200. If we see the effective rate of tax under current system, it ends up to around 20.5%, which will come down to 18% with the GST effect.

GST Effect on Restaurant

The smaller outlets like food courts, dhabas, coffee bars cater to large segments of population on daily basis. The maximum people who fall in this business category earn modest income and thus the new tax format is likely to come under criticism. All kinds of hotels whether it is AC or non-AC will definitely collect the higher rate and this will bring an overall price hike in food items.

According to the latest GST update budget, hotels that are charging Rs 1000 per day for rooms are exempted from taxes. Hotels that are charging Rs 5000 or more room tariff per day will have to pay 28 per cent GST which is a big threat to country’s developing tourism and hospitality. Restaurants in such hotels too, will have to pay 28 per cent GST.

Under the current tax regime, restaurant business owners do not get any option to adjust the output service tax liability with the credit of input VAT on goods consumed, hence restaurant owners are in no mood to cheer for the GST bill.

Price hike in food can be expected in the upcoming days. If you are very fond of eating outside, you might now need to check your pockets when you plan on it.